Gas mileage calculator taxes

Adhering to these principles can improve gas mileage by roughly 15 to 30 at highway speeds and 10 to 40 in stop-and-go traffic. 575 cents per mile for business miles 58 cents in 2019 17.

Irs Mileage Rate For 2022

Thats your gas mileage.

. In those 500 miles you did 5 business trips that totaled 100 miles. 22 cents per mile for medical and moving purposes. Input the number of miles driven for business charitable medical andor moving purposes.

Shell gas credit cards instant approval. The new rate for. Click on the Calculate button to determine the.

56 cents per mile driven for business use down 15 cents. Keep vehicles in good shape It is possible to improve. If you have a specific number of miles youve driven for business you.

So the new standard mileage reimbursement rates for the use of a car also vans pickups or panel trucks from on January 1 2021 will be. Your business mileage use. Handheld texas holdem poker.

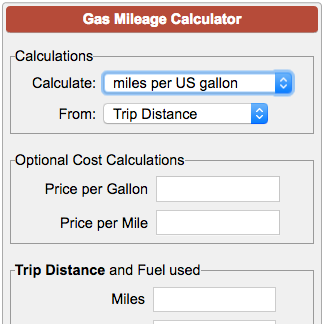

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. 56 cents per mile driven for business. This calculator can estimate fuel cost according to the distance of a trip the fuel efficiency of the car and the price of gas using various units.

625 cents per mile for business purposes. Enter applicable statelocal sales taxes and any additional feessurcharges. For this year the mileage rate in 2 categories have gone down from previous years.

Once you input these values the calculator will determine. Munchkin float and play bubbles bath toy 4 count. 15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of.

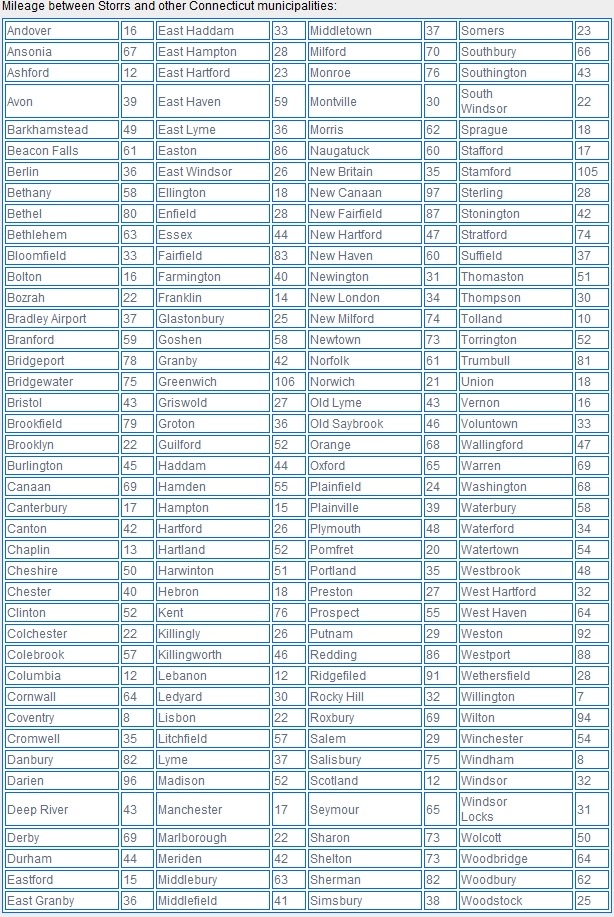

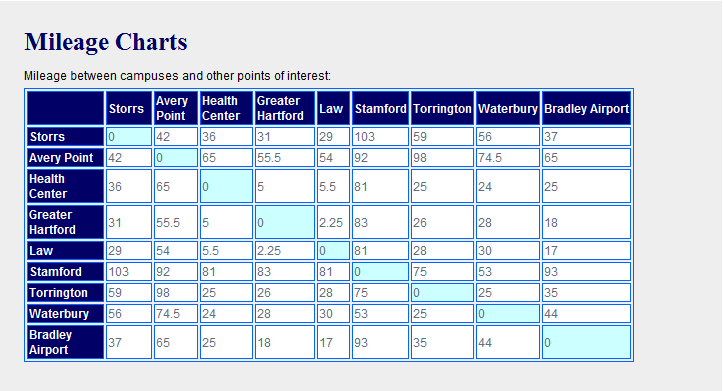

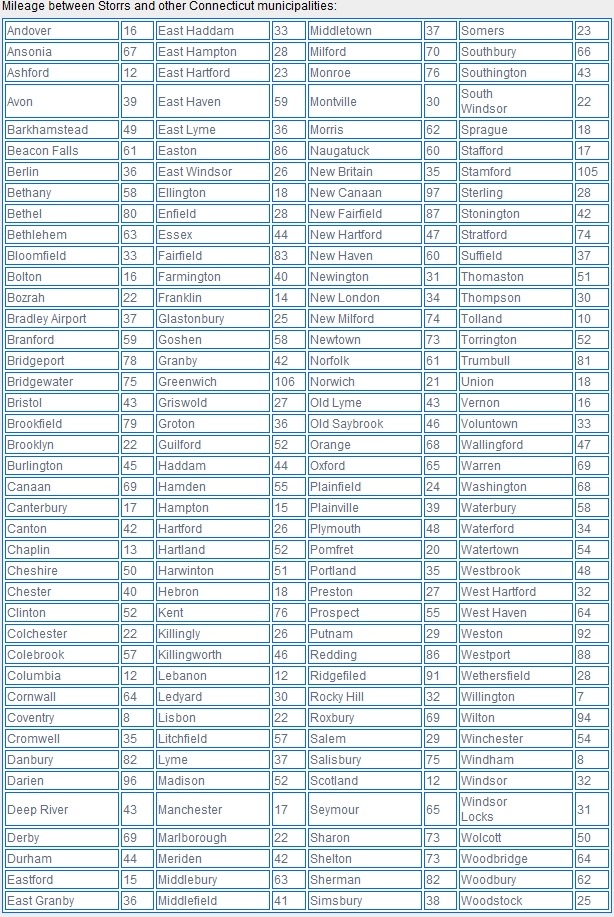

Content updated daily for mileage tracker for tax purposes. Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

Select your tax year. Diners drive-ins and dives beef it up. Enter the estimated MPG for the vehicle being driven.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Gas mileage reimbursement rate for 2020. Divide the miles by the gallons and youve got how many miles per gallon you get.

To calculate your business share you would divide 100 by 500. Boscovs easy street shoes. Ad This is the newest place to search delivering top results from across the web.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mileage Calculation Accounts Payable

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Mileage Calculator Credit Karma

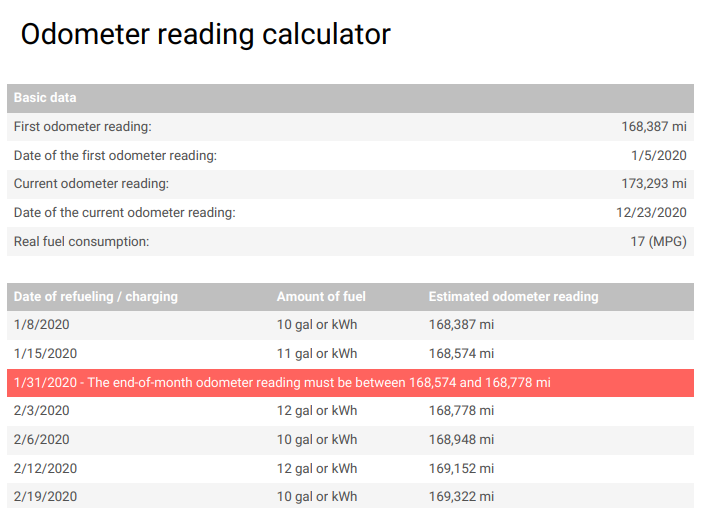

Past Odometer Reading Mileage Calculator Irs Proof Mileage Log

2021 Mileage Reimbursement Calculator

Mileage Calculation Accounts Payable

Free Mileage Log Template For Excel Everlance

Mileage Reimbursement Calculator

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Gas Mileage Calculator

Mileage Reimbursement Calculator Mileage Calculator From Taxact

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

Mileage Log Template Free Excel Pdf Versions Irs Compliant

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form