26+ tax deduction on mortgage

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have.

Changing Rates And The Market House Hunt Victoria

The standard deduction for married.

. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

However higher limitations 1 million 500000 if. Web Investing in real estate can provide valuable tax benefits such as deductions on mortgage interest property taxes home improvements and depreciation expenses. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

Single taxpayers and married taxpayers who file separate returns. If you get a 1000 tax deduction you only save the amount of the deduction multiplied by your. Say I have one 750000 mortgage at 5 and another 750000 mortgage at 3 can I choose which mortgage obviously the 6.

Web Employee Tax Expert. It all depends on how the property is used. Web The limit on the amount of interest has changed under the Tax Cuts Jobs Act.

Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Web Eligible W-2 employees need to itemize to deduct work expenses. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web Question on mortgage interest deduction. Web 1 day agoThe standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed.

Web Is mortgage interest tax deductible. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Most homeowners can deduct all of their mortgage interest.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. For the 2022-2023 tax year the standard deduction. Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a property that.

If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web For 2021 tax returns the government has raised the standard deduction to. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The short answer is.

Web Standard deduction rates are as follows. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Taxes Can Be Complex.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If you get a 1000 tax credit you owe 1000 less on your taxes. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Taxes Can Be Complex. 12950 for tax year 2022 Married taxpayers who file. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

The interest deduction pre-TCJA has been available to qualified mortgage debt up.

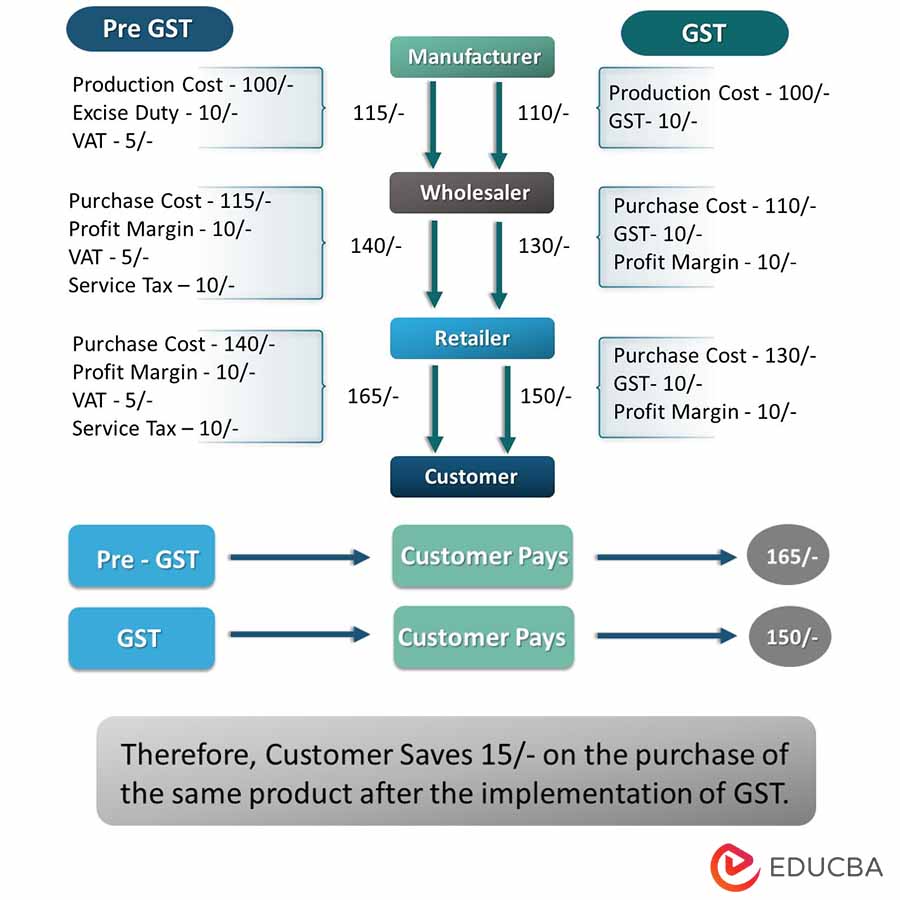

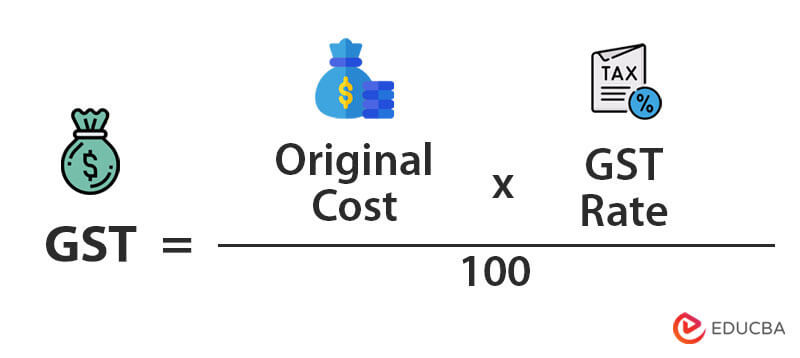

What Is Gst Types Rates Calculation Registration Examples

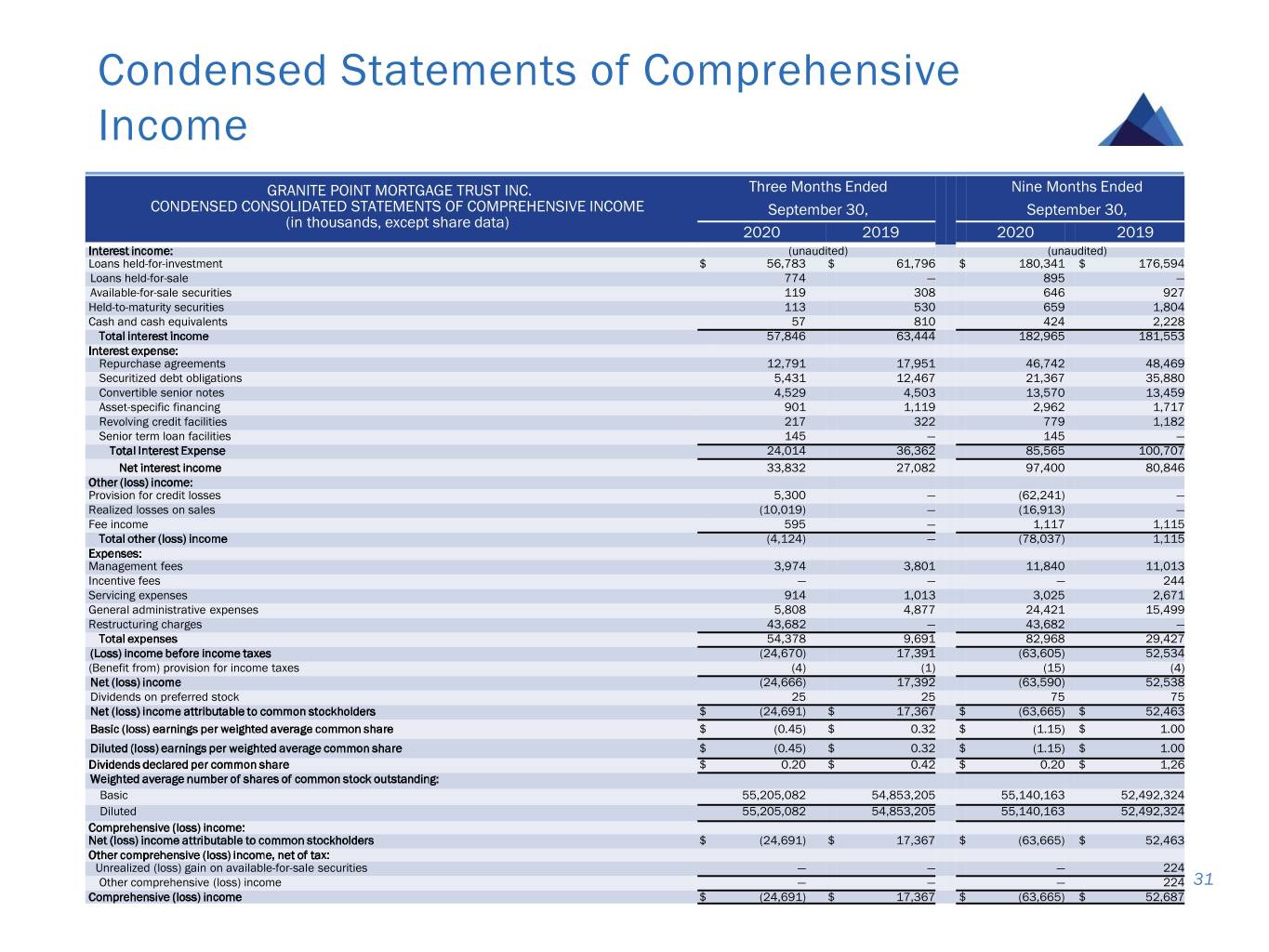

Gpmtq32020investorpresen

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Norhill Realty Har Com

Open Esds

Free 26 Payroll Templates In Excel

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Bankrate

Maximum Mortgage Tax Deduction Benefit Depends On Income

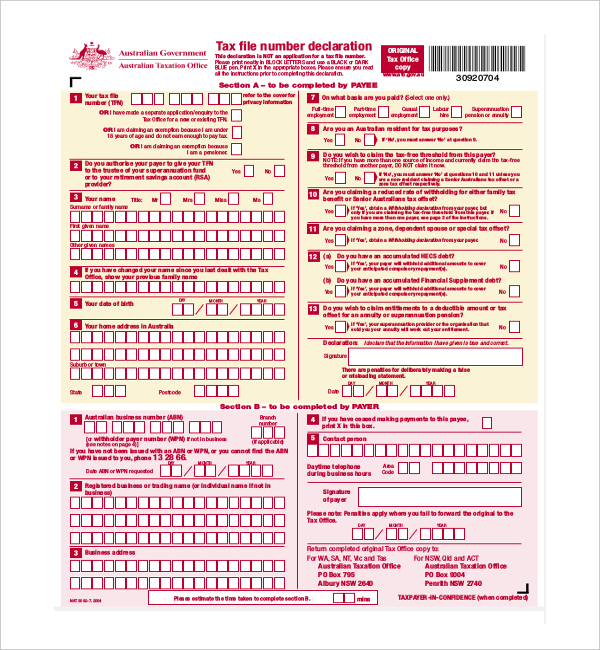

Free 11 Sample Employee Declaration Forms In Pdf Excel Word

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

What Is Gst Types Rates Calculation Registration Examples

Mortgage Interest Deduction Bankrate

Mortgage Interest Deductions Tax Break Abn Amro

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet